Traverse Standard v11.0

Post Production Activity

This section pertains specifically to the recording of finished production quantities when the assembly is selected in the Record Production Activity function. The behind the scenes accounting can be simple or quite complicated depending on how you record the production of finished goods.

Although this overview talks in terms of making General Ledger entries, in actuality, the Record Production Activity is creating transactions in a manufacturing table, which are later posted to the G/L journal via the Post Production Activity function. When these transactions are posted they are flagged as “Posted” internally, but stay in the transaction table. Essentially each record in the transaction table represents one side of a journal transaction. To see the results of this activity, print the Work In Process Valuation report.

There are four general scenarios, which can exist when recording completion of finished goods:

- You are using standard costing and recording multiple transactions for finished goods before completing and closing the order.

- You are using standard costing and as you record the finished quantity, you immediately complete/close the order.

- You are using an actual costing method, such as LIFO, FIFO, or Average Costing and recording multiple transactions for finished goods before completing and closing the order.

- You are using an actual costing method, such as LIFO, FIFO, or Average Costing and as you record the finished quantity you immediately complete/close the order.

See the Posting to a Closed Period topic for additional information about posting to a closed fiscal period/year.

Standard Costing Environment

Each time you record the production of inventory the following transactions take place.

- Inventory is created and put in stock. Each piece's unit cost is set to Standard, Average, or Last, depending on the selection for the Interim Assembly Cost business rule.

If the selected cost is $60.00 and we create 500 units, we will now see 500 units as $60.00 apiece under the Cost Detail tab in inventory regardless of what the real cost should or will be until you mark the order as 'Completed'.

- The GL inventory asset account as determined by the item's account code, is debited for $30,000.00.

- The WIP account for the item, also as determined by the item's account code, is credited for $30,000.00.

Post Production Activity Account Entry Amount Inventory Debit $ 30,000.00 WIP Credit $ 30,000.00

When you are ready to complete the order

- You may enter additional quantities at this time or you may just want to simply close the order release by changing the status to 'Completed'.

- If you have recorded additional quantities, inventory is created and put in stock. Each piece's unit cost is set to the cost selected in the Interim Assembly Cost business rule.

If, per the previous example, the selected cost is $60.00 and we now are adding an additional 100 units, we will now see 100 additional units at $60.00 apiece under the Cost Detail tab in inventory.

- Again, the GL inventory asset account, as determined by the item's account code, is debited for $6000.00 in this case and again the WIP account for the item, also as determined by the item's account code, is credited for $6000.00.

Post Production Activity Account Entry Amount Inventory Debit $ 6,000.00 WIP Credit $ 6,000.00

At this point, assuming the order has been completed, the system adds up the total actual cost of all subcontracting, materials, time, etc. This total is compared against the total cost of finished goods at standard cost. If the two amounts are equal, nothing happens. This is almost never the case because material quantities will be more or possibly less than expected, time may vary, costs may have changed, etc. In these cases the WIP account will need to be adjusted accordingly since the offsetting credit made early won't match the debits made to this account as costs were incurred, so the system calculates the difference and posts it against the WIP account to essentially “zero” that account out for this order release. It then posts that same amount to the item's Standard Cost Variance account as an offset to the WIP entry.

For Example: We add our actual material, machine, overhead, subcontracting and labor costs up and come up with $40,000.00 instead of the expected $36,000.00. The $4000.00 difference is credited against WIP, which was originally debited for $40,000.00 but only credited for $36,000.00 as we saw above. We also debit the Standard Cost Variance account for $4000.00.

Again, the GL credit account is the WIP account of the item ID. The amount is attained by calculating the difference between the total actual costs and the total selected (from the Interim Assembly Cost business rule) cost.

| Post Production Activity | ||

|---|---|---|

| Account | Entry | Amount |

| Standard Cost Variance | Debit | $ 4,000.00 |

| WIP | Credit | $ 4,000.00 |

In this scenario we assume no previous “completed” transactions have been recorded. This scenario is handled almost exactly the same as completing an order in Scenario 1 except it all takes place at one time.

You will enter quantity produced and complete the transaction by assigning the order release the status of 'Completed'.

- Once you do this, inventory is created and put in stock. Each piece's unit cost is set to the cost selected in the Interim Assembly Cost business rule.

If the selected cost is $60.00 and we now are entering 600 units, we will now see 600 units at $60.00 a piece under the Cost Detail tab in inventory.

- The GL inventory asset account, as determined by the item's account code, is debited for $36,000.00. The WIP account for the item, also as determined by the item's account code will credited for $36,000.00, but in addition to the $36,000.00 some further calculations must be done.

- Again the system adds up the total cost of all subcontracting, materials, time, etc. This total is compared against the total cost of finished goods. Assuming the two amounts are not equal, we will need to adjust the WIP account accordingly. Again, the system calculates the difference and posts it against the WIP account to essentially “zero” that account out for this order release. It then posts that same amount to the item's Standard Cost Variance account as an offset to the WIP entry.

Post Production Activity Account Entry Amount Standard Cost Variance Debit $ 4,000.00 Inventory Debit $ 36,000.00 WIP Credit $ 40,000.00

Actual Costing Environment

When you record the production of inventory but don't close the production order, the behind the scenes activity is exactly the same as seen in a standard cost environment per Scenario 1. As finished goods are recorded, WIP is credited and Inventory is debited based on the cost selected in the Interim Assembly Cost business rule. The cost used to initially update Inventory will be based on Standard, Average, or Last as selected for the business rule. In other words, even if you are using FIFO, LIFO, or Average Cost, newly created inventory, which appears under the Cost Detail tab, will appear at the cost you selected for the Interim Assembly Cost business rule until you mark the order as completed.

Let's assume we manufactured 120 units at this point and the selected cost was $100.00. Regardless of the real costs incurred, here's the accounting flow assuming the order release was left 'In Process'.

| Post Production Activity | ||

|---|---|---|

| Account | Entry | Amount |

| Inventory | Debit | $ 12,000.00 |

| WIP | Credit | $ 12,000.00 |

When the order is marked as completed, the system looks to see if any of the produced inventory was sold. If so, the system creates a COGS entry in inventory for the difference between the selected cost (from the Interim Assembly Cost business rule) of the items sold and the actual cost of the items sold. Then the remaining inventory unit cost is simply changed to the actual production cost. If the remaining inventory quantity matches the production quantity, the system simply replaces the previous cost, based on the selected cost (from the Interim Assembly Cost business rule), with the new actual inventory cost.

From a general ledger standpoint, the previous entry is backed out and a new entry will replace it.

Let's assume in this case that we actually produce an additional 60 units, or 180 units in all, and the actual cost results in a cost of $120.00 per unit or $21,600.00 overall. The following entries are made:

| Selected Costs | ||

|---|---|---|

| Account | Entry | Amount |

| Inventory | Credit | $ 12,000.00 |

| WIP | Debit | $ 12,000.00 |

| Actual Costs | ||

| Account | Entry | Amount |

| Inventory | Debit | $ 21,600.00 |

| WIP | Credit | $ 21,600.00 |

This may look correct but there's a potential issue:

What if we sold 50 units of that first 120 units, prior to completing the order? The sales process would have credited our inventory account for $5000.00 (50 x $100.00) based on the cost at that time.

Now our inventory quantity shows 130 units (180-50) and our unit cost shows $120.00 per unit or $15,600.00. This is the number that appears in Inventory. The issue is that the inventory GL account shows $16,600.00. (12,000 initial mfg order - 12,000 reversal - 5000 sale transaction + 21,600 final mfg trans) This is the number that appears in GL.

However, keep in mind we have a COGS entry which equals the difference between the selected (from the Interim Assembly Cost business rule) cost and the actual cost for the quantity previously sold, or simply $1000.00. (50*(120.00-100.00)) When COGS adjustments are posted, the system will credit inventory for $1000.00 and debit the COGS adjustment account for $1000.00 and inventory will be back in sync with the GL.

| COGS Adjustment | ||

|---|---|---|

| Account | Entry | Amount |

| Inventory | Debit | $ 1,000.00 |

| COGS Adjustment | Credit | $ 1,000.00 |

In this scenario we assume no previous “completed” transactions have been recorded. This scenario is handled somewhat similar to Scenario 3 except it all takes place at one time. It also assumes you have entered a transaction and completed it by assigning the order release the status of 'Completed'. You have entered the quantity produced at this same time in the same transaction.

Since the product could not have been sold and since no previous partial completions were recorded, the GL results are simple and straight-forward.

Given a scenario similar to the previous scenario, here's what we would see:

| Post Production Activity | ||

|---|---|---|

| Account | Entry | Amount |

| Inventory | Debit | $ 21,600.00 |

| WIP | Credit | $ 21,600.00 |

Labor, Machine Costs, Overhead, Subcontracted, and By-Products

When Labor Costs, Machine Groups, and Work Centers are set up using the Routing and Resources application, GL accounts are entered to track labor costs, machine costs, and overhead costs.

When an operation is set up as a subcontracted type we need to update GL accounts with the cost of this subcontracted amounts.

By-Products are produced and put into inventory when we record what we produced for by-products when our production is recorded and GL also will get updated with these amounts added to inventory.

The following GL accounts will have journal entries added to GL using the following accounts:

When labor is posted, either from the Record Production Activity or Record Time Activity functions, the following GL entries are made:

| Post Production Activity | |

|---|---|

| Account | Entry |

| WIP | Debit |

| Labor Offset | Credit |

The WIP account will come from the inventory account code assigned to the assembly item id from the inventory item setup. The labor offset account comes from the labor costs setup in Routing and Resources.

When machine costs are posted from entries made using the Record Production Activity function, the following GL entries are made:

| Post Production Activity | |

|---|---|

| Account | Entry |

| WIP | Debit |

| Machine Cost Offset | Credit |

The WIP account will come from the inventory account code assigned to the assembly item id from the inventory item setup. The machine cost offset account comes from the machine groups setup in Routing and Resources.

Overhead is calculated using the information entered into the Labor Types setup in Routing and Resources. The overhead is calculated either as a percent over cost or by an hourly rate, indicated in the labor types setup.

When overhead is posted from entries made using the Record Production Activity function, the following GL entries are made:

| Post Production Activity | |

|---|---|

| Account | Entry |

| WIP | Debit |

| GL Offset | Credit |

The WIP account will come from the inventory account code assigned to the assembly item id from the inventory item setup. The GL offset account comes from the labor types setup in Routing and Resources.

When subcontracted items are posted from entries made using the Record Production Activity function, the following GL entries are made:

| Post Production Activity | |

|---|---|

| Account | Entry |

| WIP | Debit |

| Subcontract Expense | Credit |

The WIP account will come from the inventory account code assigned to the assembly item ID from the inventory item setup. The subcontract expense account comes from the subcontract operation setup in Routing and Resources.

When material by-product production is recorded, inventory is increased for the components of the assembly, and GL entries are made to record this addition to inventory quantities and values.

When component by-product production items are posted from entries made using the Record Production Activity function, the following GL entries are made:

| Post Production Activity | |

|---|---|

| Account | Entry |

| WIP | Credit |

| Inventory | Debit |

The WIP account and inventory account will come from the inventory account code assigned to the component item id from the inventory item setup.

Raw Materials

When material usage is recorded, inventory is depleted for the components of the assembly and GL entries are made to record this reduction in inventory quantities and values.

When component usage items are posted from entries made using the Record Production Activity function, the following GL entries are made:

| Post Production Activity | |

|---|---|

| Account | Entry |

| WIP | Credit |

| Inventory | Debit |

The WIP account and inventory account will come from the inventory account code assigned to the finished goods Bill of Material Item ID from the inventory item setup.

Posting Production Activity

Use the Post Production Activity function to perform several tasks:

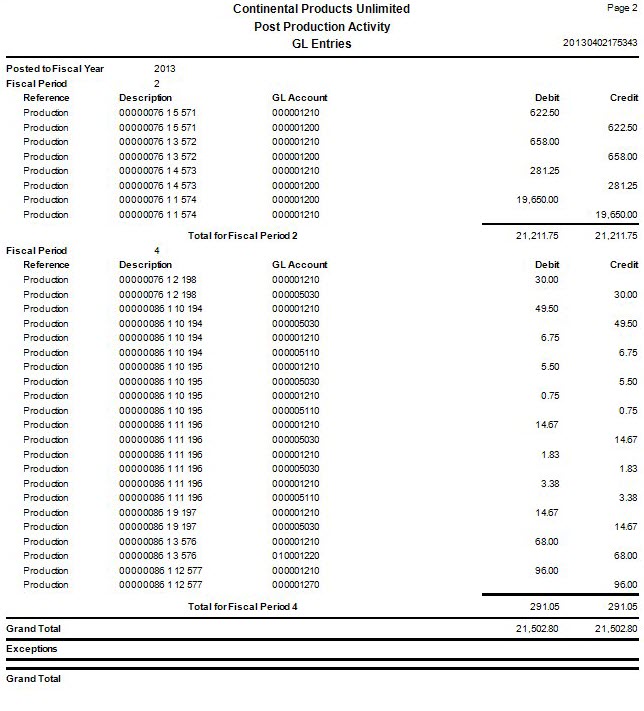

- If interfaced, post activity to General Ledger.

- If an order release is closed, post transactions stored with that order release in the manufacturing history database.

- Clear the production order release and related information for closed order releases.

- If there are no releases for any given production order, clear the order from the system.

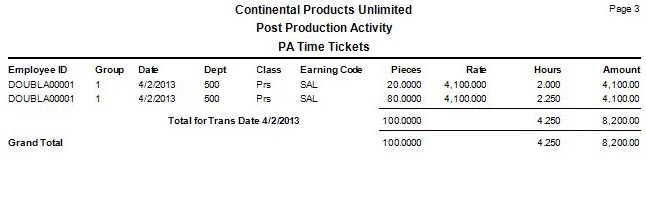

- If interfaced with Payroll, post the time recorded for labor to the payroll transactions table.

Follow this process:

- Complete recording of finished production or adjustments.

- Print the Work in Process Valuation.

- Print, if applicable, the Employee Time Log.

- Select the Do the following, then check the box check box.

- Select the Move Completed Orders to History check box, if applicable, to move completed orders to history during posting.

- Select the Post Activity to General Ledger check box, if applicable, to post an activity log to General Ledger during posting.

- Select the Post Activity to Payroll Time Tickets check box, if applicable, to post an activity log to Payroll Time Tickets.

- Enter any applicable comments in the Comments field.

-

Click a command button to

Click To OK Begin processing. Activity View the Activity Log for periodic processing. Reset Set all fields to their default values.