Traverse Standard v11.0

Post Unrealized Gains and Losses

Use the Post Unrealized Gains and Losses function, if you use multicurrency, to balance accounts and close the books as part of your period-end processing.

When you post unrealized gains and losses, Traverse performs these actions:

- Identifies the accounts that use currencies other than the base currency and calculates the gain and loss amounts that would result if those amounts closed at that moment using the most current periodic exchange rate.

- Creates entries for these amounts in the accounts you specified in the System Manager Gains and Losses Accounts function to balance accounts for correct accounting so that you can close the books.

- Creates a reversing entry in the next period (with the date you specify) that reverses these entries to make way for the actual realized gains and losses that were recorded when you post payments.

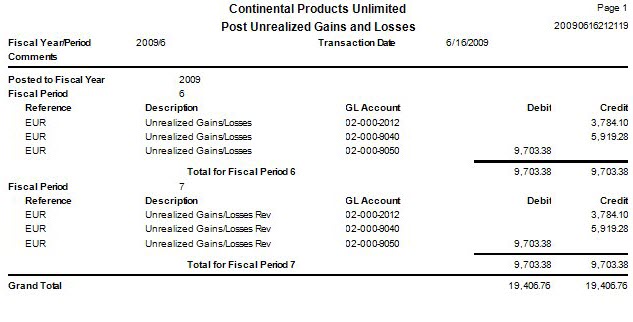

The entries that Traverse makes when you post are noted on the Unrealized Gains and Losses Report. Print this report before you post unrealized gains and losses to verify these entries.

- Set up the periodic exchange rate for the current fiscal period and year.

- Print the Unrealized Gains and Losses Report.

- Select the Do the following, then check the box check box.

- Select the fiscal year from the Fiscal Year field.

- Select the fiscal period to which to post unrealized gains and losses from the Period field.

- Select the date to use for the reversing entry from the Transaction Date field.

- Enter any applicable comments for this post in the Comments field.

- Click a command button to

| Click | To |

| OK | Begin posting the unrealized gains and losses. |

| Activity | Open the Activity Log dialog box where you can view information about previous post actions, including run time, user ID, and comments, as well as internal sequence numbers and run IDs. |

| Reset | Set all fields to their default values. |