Traverse Standard v11.0

Variables

You can use positive or negative numbers (constants) in formulas. You can also use the variables below in place of the numbers:

Note: All variables must be enclosed in quotes " "

When working with variables in a formula for Traverse 11 you must first select the f.GetNumericVariable command from the list of selections. The variable must be enclosed in quote marks within the parentheses: f.GetNumericVariable(“TAXEARN”).

| Variable | Description |

| ADJEARN* | Adjusted earnings for net pay deductions. |

| ADJHR | Adjusted hours, minus exclusions. |

| ADJMIN | Adjust to minimum wage flag. |

| ADJSUIEARN | Total SUI earnings before the Self Adjust Month changed. |

| ADJSUIWITH | Total SUI withholdings before the Self Adjust Month changed. |

| DEDEXCL | Total amount of deductions exclusions. |

| DEDUCTIONTOT | Total deductions for the current check. |

| EARNEXCL | Total amount of earnings excluded. |

| EARNHOURSEXCL | Total hours excluded. |

| EICCODE | EIC code for each employee (N, E, B, or M). |

| EMPDEPT | Default department ID for the current employee. |

| EMPFICAWH | Employee FICA Contribution (OASDI and Medicare). |

| EMPTYPE | Employee type (H or S). |

| EXEMPTIONS | Number of exemptions per employee. |

| EXTRAWH | Extra withholdings for the employee. |

| FEDEXEMPT | Number of federal exemptions for the employee. |

| FEDEXTRAWH | Extra federal withholding for the employee. |

| FEDFIXEDWH | Fixed federal withholding amount for the employee. |

| FEDMARITSTATUS | Marital status of the employee for federal withholding. |

| FEDWITH | Total employee federal withholdings (including OASDI, Medicare, and EIC.) |

| FIXEDEARN | Total fixed earnings for the employee. |

| FIXEDPCT | Fixed percent for the withholding. |

| FIXEDWH | Fixed withholding amount. |

| FWHWITH | Employee federal withholding (not including OASDI, Medicare, and EIS). |

| GETDEDUCTION | Retrieve a deduction taken out of an employee's check. Need to list deduction code in ("xxx"). |

| GRANDTOTEARN | Total gross earnings, not including earnings that are not included in net pay. |

| GRANDTOTGROSS | Total gross earnings, including all earnings. |

| GRANDTOTNET | Net pay for the employee. |

| HOURS | Total hours worked. |

| LOCALWITH | Total employee local withholdings. |

| MINWAGE | Minimum wage. |

| NETDEDTOT | Total deductions based on the net pay for the employee. |

| PALOCAL | Local code if calculation local withholding. |

| PASTATE | State code if calculating state withholding. |

| PASTATUSCODE | Current withholding code. |

| PAYPERIODS | Total pay periods for the year; taken from the tblPaEmpGenInfo table. |

| PAYEAR | The payroll year to bring data into the formula from. |

| PERIODCODE | Current deduction run code for the group code the current employee is in. |

| REGHRS | Regular hours worked. |

| STATEWITH | Total employee state withholdings. |

| STATUS | Marital status for current withholding. |

| TAXEARN | Taxable earnings per tax authority (total earnings minus all exclusions). |

| TAXHOURS | Taxable hours per tax authority (total hours minus all exclusions). |

| TAXMONTH | Tax month being processed (as set in the Business Rules) |

| TIPS | Tips accumulated for the employee. |

| TOTEARN | Total earnings. |

| UNCOLMED | Year-to-date uncollected Medicare. |

| UNCOLOASDI | Year-to-date uncollected OASDI. |

| WEEKSWORKED | Number of weeks worked for the employee. |

| WEEKSWORKEDLIMIT | The value from the tax authorities setup in the weeks worked limit field. |

| WITHHOLDINGEARNINGS | Earnings used to calculate current withholding amount. Accounts for limits. |

| YTDEARNINGS | Year-to-date earnings for the withholding. |

| YTDFICATIPS | Year-to-date FICA tips (used in employee OASIDI to figure FICA tips). |

| YTDTIPS | Year-to-date tips deemed as wages (used in employer OASDI adjustments). |

| YTDWITHHOLDINGS | Year-to-date withholdings for the withholding. |

| * For Gross, ADJEARN is set to the same amount as GRANDTOGROSS, minus any earning code exclusions that may exist for that deduction. For Net, ADJEARN is set to GRANDTOTEARN. Then DEDUCTIONTOT. FEDWITH, STATEWITH, and LOCALWITH are subtracted to account for all withholdings up to that point. So if you have two net pay deductions, the first one is calculated and that amount is added to DEDUCTIONTOT. The second deduction will follow the same process, with DEDUCTIONTOT having the updated deduction total from the previous net pay deduction. | |

Note: All variables must be enclosed in quotes " ".

| Variable | Description |

| CALC_COLUNCOLMED | Collected on Uncollected Medicare. |

| CALC_COLUNCOLOASDI | Collected on Uncollected OASDI. |

| CALC_FICATIPS | Recorded FICA tips. |

| CALC_TAXABLE | Taxable earnings. |

| CALC_TDW | Adjusted SUI withholdings. |

| CALCVALUE | The final value calculated by the formula. |

Text variables can be used to return a variable that has a text value. Text variables can be used to bring in things like statuses for tax purposes. The formula might depend on a status to calculate a different amount based on the status an employee is set up for.

Test variables are grouped, in the formula box, by the heading #text variables.

Note: All variables must be enclosed in quotes " ".

| Variable | Description |

| EICCODE | The EIC code selected in the employee information setup. |

| EMPDEPT | Employee's department code. |

| EMPLABORCLASS | Employee's labor class. |

| EMPTYPE | Employee's wage type: Hourly or Salaried. |

| FEDMARITSTATUS | The status selected on the federal tax tab in the employee information setup. |

| LOCALCODE | Local tax code. |

| STATECODE | State tax code. |

| STATUS | The status selected on the state and local tax tabs in the employee information setup. |

| TABLEID | The table ID used for the formula. |

Formula factors are variables used to change the base rate in a formula without changing the formula. Each formula can have six factors. Factors can be used in formula lines by entering [FCn], where n is the number of the factor.

When working with variables in a formula for Traverse 11 you must first select the f.GetNumericVariable command from the list of selections. The variable must be enclosed in quote marks within the parentheses: f.GetNumericVariable(“FC1”)

For example, you can set up a formula that multiplies taxable earnings by a percentage. The formula can be one line long:

f.GetNumericVariable(“FC1”) * .5

If you set Factor 1 to .05, the employee’s taxable earnings will be multiplied by five percent. Later you can change the factor or override it in the employee record.

NOTE: Formula factors can be overridden for deductions on the Employee Information screen's Federal, State, and Local Taxes tabs, and also on the Employee Information screen's Deductions and Employer Costs tabs.

Each line of a formula sets the value of a variable [LInnn] (nnn is the line number). Lines are calculated in sequential order: line [LI001] is calculated before [LI002] and so on. You can use the results of previous lines with other variables in later formula lines. The result of the entire formula is the result of the last line you defined.

Note: All line references must be enclosed in quotes " ".

Each line of a formula sets the value of a variable Ln (where n corresponds to the line number the value of the variable is calculated on). Lines are calculated in sequential order, line L1 is calculated before L2, and so on. You can use variables storing the results of previous lines with other variable in subsequent formula lines. The result of the entire formula is the result of the calculation on the last line of the formula.

Line numbers can be defined many ways in the Traverse formulas. Most of the examples in this chapter use the L1, L2 convention for naming lines other examples could be y1, y2, y3 etc.... You can use any character reference prior to the equal sign = to define a line number. The important thing to remember is what you used to define the line number to use later in the formula.

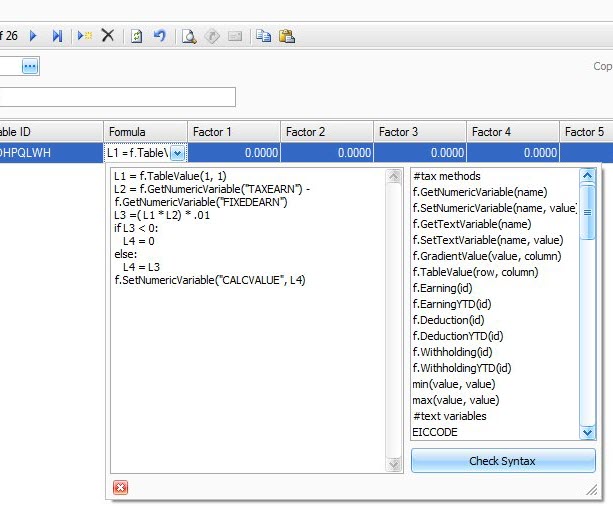

Example: In line 3 (L3) of the formulas displayed on the following screen, L3 stores the amount calculated in line 2 L2 of the formula. L1 is the amount retrieved for the table in line 1. (The table to be used with this formula is assigned when the withholding code is set up when you set up the tax authority). These variables are used to calculate an amount in line 3 and then that amount is stored as the variable L3 and used in the if, then, else statement that gives us our tax amount.

Note: All line references do not need to be enclosed in brackets [ ].